Continuing the reasons for not increasing taxes on the wealth from the previous Money Tree blog.

Reason 3: It is socially divisive such that the rich resent the poor who are benefiting from their work. However, I would think that the reverse is more pertinent that the poor and middle class resent the rich who could pay but aren’t. As seen in The Money Tree Parts 1 & 2, the rich are becoming more wealthy and it is reasonable to expect them to pay more.

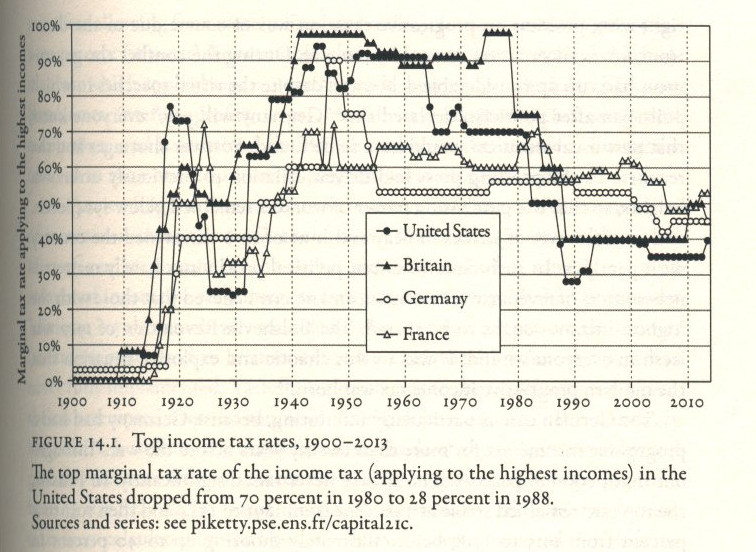

As shown above (Fig. 14.1), previously when governments needed to refill the coffers they applied high taxes on the rich. That such an approach was not applied after the 2008 financial crisis probably reflects the influence of the ‘Chicago School of Economics’ adopted by Margaret Thatcher and continued thereafter. The psychology of the brain’s ‘Sunk Cost’ bias means that it is very difficult for politicians to say ‘well, we’ve been following the wrong economic model for the past 37 years’. This would not garner many votes! Much easier to believe you have been right and ignore all evidence to the contrary.

We have shown that the wealthy have considerable money left after the current tax regime takes its cut. Some of this contributes to the increase in capital wealth since about 1980. This forms a Money Tree from which a government may choose to take more pickings. Some countries have higher top rates of tax, such as Sweden, Netherlands & Denmark. A few have a wealth tax which could become an additional source of revenue. Many arguments can be found against a wealth tax, these are mostly ideological or practical in nature. However, the rapid advances in computing and networking make many objections on the practicalities outdated. It should be noted that the Council Tax is a ‘Part Wealth’ tax, based on 1991 property values, so hardly current! Governments appear to be afraid to update the values since that would annoy those where values have risen most, the south east and the wealthy!

Since 1980 no government has shown any interest in taxing the wealthy to any significant extent more than the current system. Even Mr. Corbyn does not make any radical proposals. The tax proposals in the 2017 Labour Party manifesto, a shifting down of band thresholds and top rate of 50%, would have almost no significant effect on the wealthy or their accumulation of wealth. The public are now attuned to ‘low’ taxes for the wealthy, 40-50%. Without a concerted campaign by UK economists and the media to demonstrate the viability of the alternative systems described above I would expect the public to view such ideas as coming from the ‘lunatic fringe’. In this regard, newspapers support the status quo. However, with the advent of social media it remains possible for other ideas to take hold rapidly.

Pingback: The Money Tree (Part 3) - Wrong Views