Following from the previous The Money Tree blog we are now looking at reasons for not increasing taxes on the wealthy.

Reason 1: High taxes reduce investment, thus reducing the support for businesses/entrepreneurs, increasing unemployment and decreasing growth. This is related to Reason 2 – High taxes are a disincentive to individuals to make money. Talented business people/entrepreneurs may leave the country with the same results as for Reason 1.

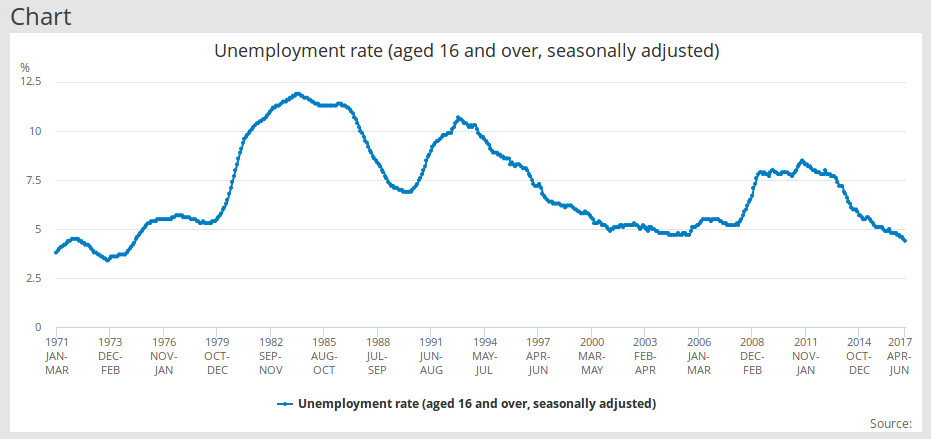

There is no relationship between tax and growth or unemployment.

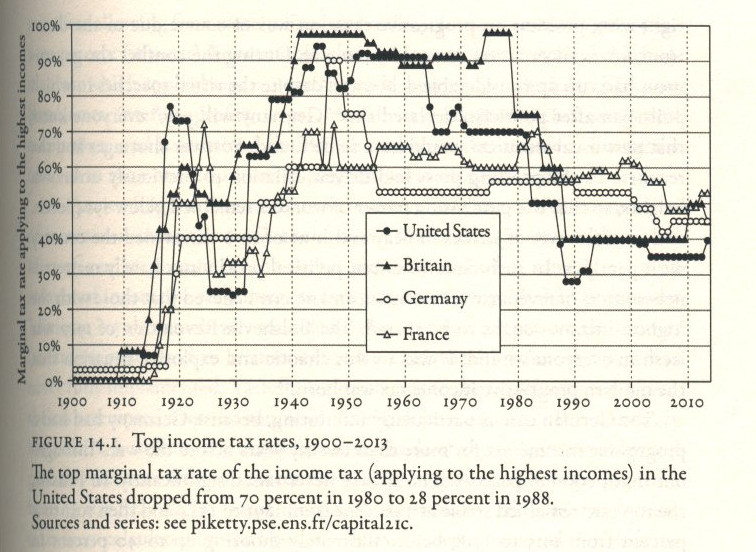

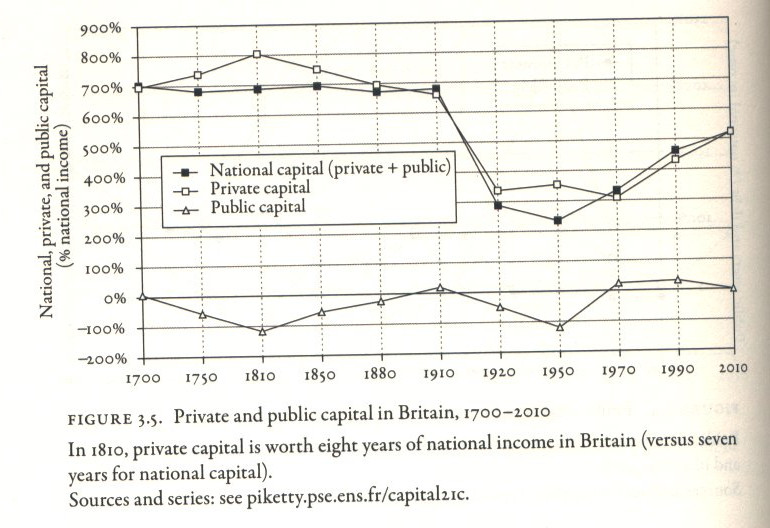

The only relationship to tax is that when the top tax rate was reduced by Margaret Thatcher from 80% to 40%, 1979-1988, the rich started to become wealthier (Figs. 14.1 & 3.5).

The supposed relationships suggesting high tax is bad, low tax is good, presented by conservative leaning economists and politicians are just rhetoric for which there is no evidence. Here is a quote from the conclusion in the earlier reference:

“The argument that income tax cuts raise growth is repeated so often that it is sometimes taken as gospel. However, theory, evidence, and simulation studies tell a different and more complicated story. Tax cuts offer the potential to raise economic growth by improving incentives to work, save, and invest. But they also create income effects that reduce the need to engage in productive economic activity, and they may subsidize old capital, which provides windfall gains to asset holders that undermine incentives for new activity.”

The Conservatives like to present themselves as the party of low taxation. However, Fig.14.1 shows that the top tax rate was about 90% from WW2 to 1980 covering governments of all persuasions. Inheritance tax rates were similarly high. This was the response of all UK governments to bring down the post war national debt. This contrasts with the response to the debt following the 2008 financial crisis.

This period was also the time when entrepreneurs such as Sir Richard Branson and Lord Sugar started their business careers, the high top rate of tax did not stop them. Entrepreneurs are driven to full fill their ideas. By the time they pay the top rate of tax they will have succeeded!

You will be able to find lots of papers & web-sites that report low taxes promote growth. I will leave you to determine their veracity.

The next post will look at Reason 3 and weather a wealth tax can be applied to The Money Tree.

Pingback: The Money Tree (Part 2) - Wrong Views